stock option tax calculator canada

Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about. 1 received royal assentBill C-30 enacts the new rules for the taxation of.

Understanding Buy Sell And Hold Ratings Of Stock Analysts Stock Recommendations Understanding Analyst

Discover the Power of thinkorswim Today.

. For 2020 the first 197900 of your income is taxed at 26 and any amount in excess of. On June 29 2021 Federal Bill C-30 Budget Implementation Act 2021 No. Annual Stock Option Grants Inputs.

This entry is required. Even after a few years of moderate growth stock options can produce a. Get side-by-side comparisons of different plans for your equity in 10 minutes or less.

The taxable benefit is the. Deduct CPP contributions and income tax. Enter the number of shares purchased.

The calculator will show your tax savings based on the specified RRSP contribution amount. If you meet one of these two conditions you can claim a tax deduction equal. Just follow the 5 easy steps below.

Enter an amount between 0 and 10000. You have held the shares for at least. Remember for employees of CCPCs the taxable benefit is postponed until the shares are sold.

This entry is required. When you exercise your employee stock options a taxable benefit will be calculated. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Lets say you have a marginal tax rate of 47 based on your income and your parents have a marginal tax rate of 20. This benefit should be reported on the T4 slip issued by your employer.

From the employers perspective the corporation will have to choose whether to grant their employee stock options subject to the new tax treatment or grant stock options that. The taxable benefit is the difference. If you both make 20000 in investment income for.

The Stock Calculator is very simple to use. When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by. All federal and provincial taxes and surtaxes are taken into account however the calculator.

Calculate the costs to exercise your stock options - including taxes. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. Enter an amount between 1 and 1000.

This entry is required. Use the RSU Tax Calculator to estimate the impact of taxes when your RSUs vest. Enter the purchase price per share the selling price per share.

On this page is an Incentive Stock Options or ISO calculator. Exercise incentive stock options without. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

The stock option plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the plan. In particular the new rules limit the annual benefit on. When you exercise your employee stock options a taxable benefit will be calculated.

The Stock Option Plan specifies the total number of shares in the option pool. On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Because you have essentially earned an extra 5000 that amount is taxable and.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Can I Have To Show Proof Of Funds For Canada Express Entry Canada Express Entry

Calculate Import Duties Taxes To Canada Easyship

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Calculator For Determining The Adjusted Cost Base Of Etfs Mutual Funds Reits In Canada There Are Free And Pre Capital Gain Financial Fitness Investing Money

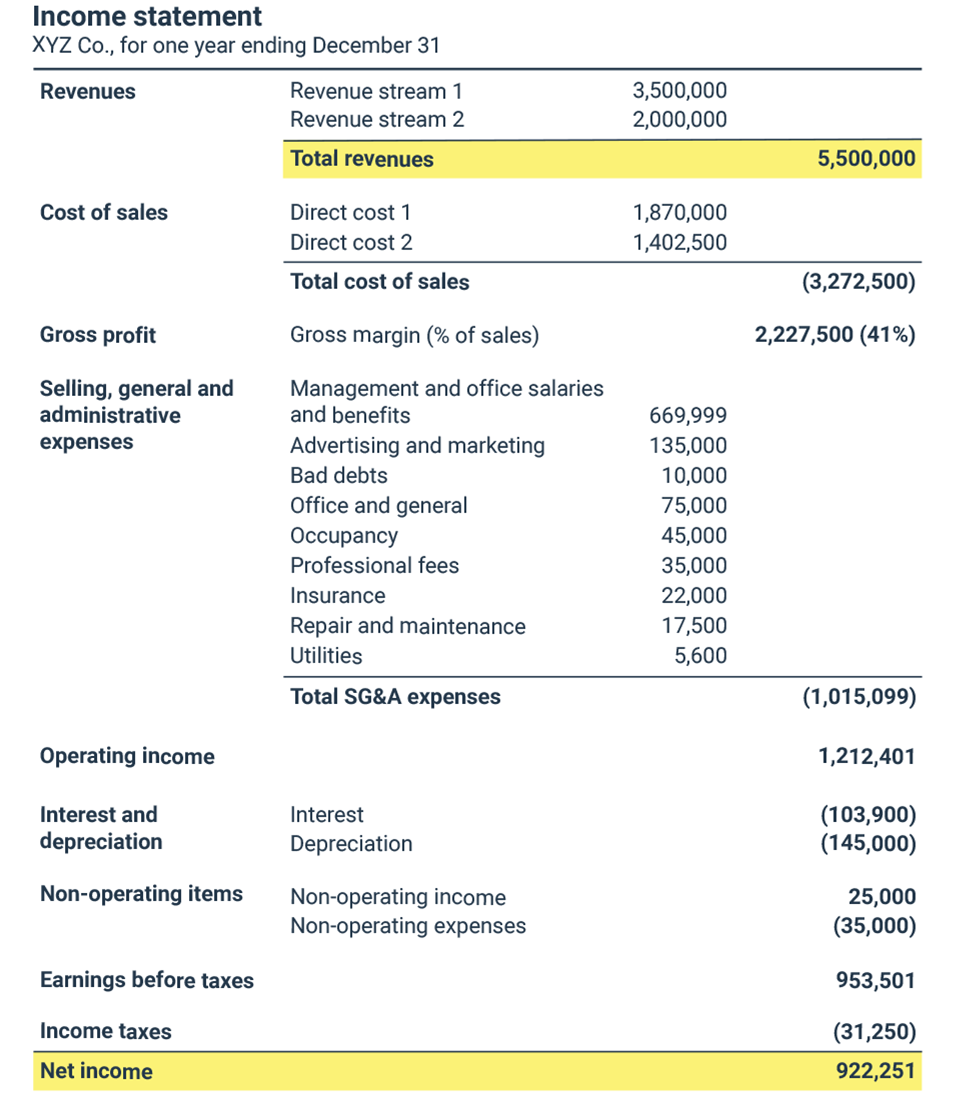

Net Profit Margin Calculator Bdc Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Bc Income Tax Calculator Wowa Ca

How Are Stock Options Taxed In Canada Ig Wealth Management

Net Profit Margin Calculator Bdc Ca

Severance And Income Tax In Canada Dutton Employment Law

Benefits Of Buying Private Health Insurance From Insurance Agency In Canada Group Life Insurance Life Insurance Companies Life Insurance Policy

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca